Credit Score Check Online – Your Free Credit Score in Minutes

With our free Credit score check online service, you can instantly view your credit score, understand your credit profile, and take control of your financial future anytime, anywhere. Whether you are an individual borrower, a loan agent, or a DSA partner, this tool is designed for you.

Why Checking Your Credit Score Online is Important

Your CREDIT score (credit score) is like your financial report card. Lenders banks, NBFCs, fintech companies, use it to decide whether to approve your loan or credit card application.

A higher score means better chances of loan approval and lower interest rates.

If you don’t know your score before applying, you’re simply walking into the loan process blind — and that can lead to rejections and negative impact on your score.

✅ The solution? Do a CREDIT score check online before applying.

What is a CIBIL Score?

A Credit score is a 3-digit number ranging from 300 to 900. It is calculated based on your credit history, repayment track record, and other financial factors.

Here’s how it is generally seen by lenders:

| Score Range | Meaning | Loan Approval Chances |

|---|---|---|

| 750 – 900 | Excellent | Very High |

| 700 – 749 | Good | High |

| 650 – 699 | Fair | Possible but with higher rates |

| 550 – 649 | Poor | Low |

| 300 – 549 | Very Poor | Very Low |

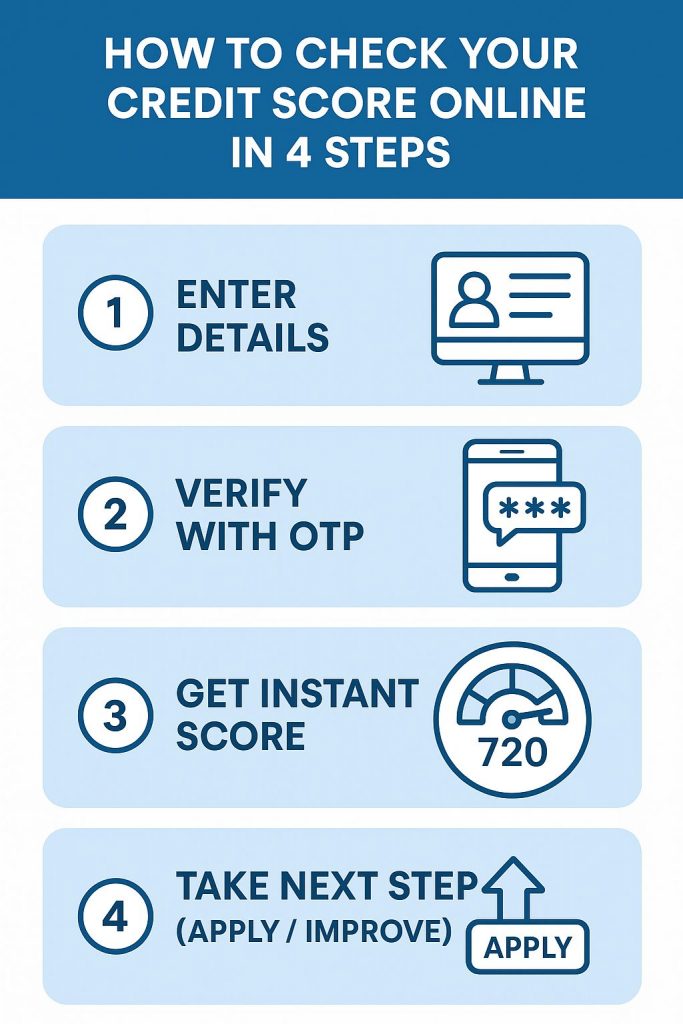

How to Do a CREDIT Score Check Online – Step-by-Step

Checking your score is easy and free. Just follow these steps:

-

Go to the Credit Score Check Page

Click on the "Check Credit Score" button on our website. -

Enter Your Basic Details

Fill in your name, date of birth, PAN card number, and contact details. -

Verify Your Identity

An OTP will be sent to your registered mobile number or email. -

Get Your Credit Score Instantly

Your CREDIT score and report will be displayed on your screen within seconds.

Pro Tip for Loan Agents & DSAs

Use this step to pre-qualify customers, saving time and increasing conversion rates.

Benefits of CREDIT Score Check Online

-

Instant & Free – Get your score within seconds without paying any fees.

-

Safe & Secure – Your data is encrypted and never shared without your consent.

-

Understand Your Loan Eligibility – Know which loans or cards you can apply for.

-

Improve Your Credit Score – Get tips to boost your score for better offers.

-

Help Customers (for Agents & DSAs) – Speed up loan approvals by matching them to suitable products.

Factors That Affect Your CREDIT Score

-

Payment History – Late or missed EMIs bring your score down.

-

Credit Utilization Ratio – Using more than 30% of your credit limit hurts your score.

-

Credit Mix – A healthy balance of secured (home loan) and unsecured (personal loan) credit is better.

-

Number of Inquiries – Too many loan/credit card applications in a short time reduce your score.

-

Credit History Length – Longer credit history with good repayment boosts your score.

Why Our Platform is the Best for CREDIT Score Check Online

-

Zero Cost – 100% free, no hidden charges.

-

Faster Than Official Sites – Get your score in less than 1 minute.

-

Designed for All – Individuals, Agents, and DSAs.

-

Mobile-Friendly – Check your score from your phone, anytime.

-

Expert Support – If your score is low, our advisors guide you to improve it.

How a Good Credit Score Benefits You

| Benefit | With High Score | With Low Score |

|---|---|---|

| Loan Approval | Fast & Easy | Delayed / Rejected |

| Interest Rate | Low | High |

| Credit Card Offers | Premium Cards | Basic Cards Only |

| Negotiation Power | High | Low |

| Loan Amount | Higher Limits | Lower Limits |

For Loan Agents & DSA Partners – Why You Should Use This Tool

Loan agents and DSAs can use our credit score checker to:

-

Pre-qualify clients instantly

-

Recommend the right lender & product

-

Avoid rejections and maintain client trust

-

Close deals faster

-

Increase conversion rates

With a CREDIT score check online, you save time, reduce paperwork, and improve customer satisfaction.

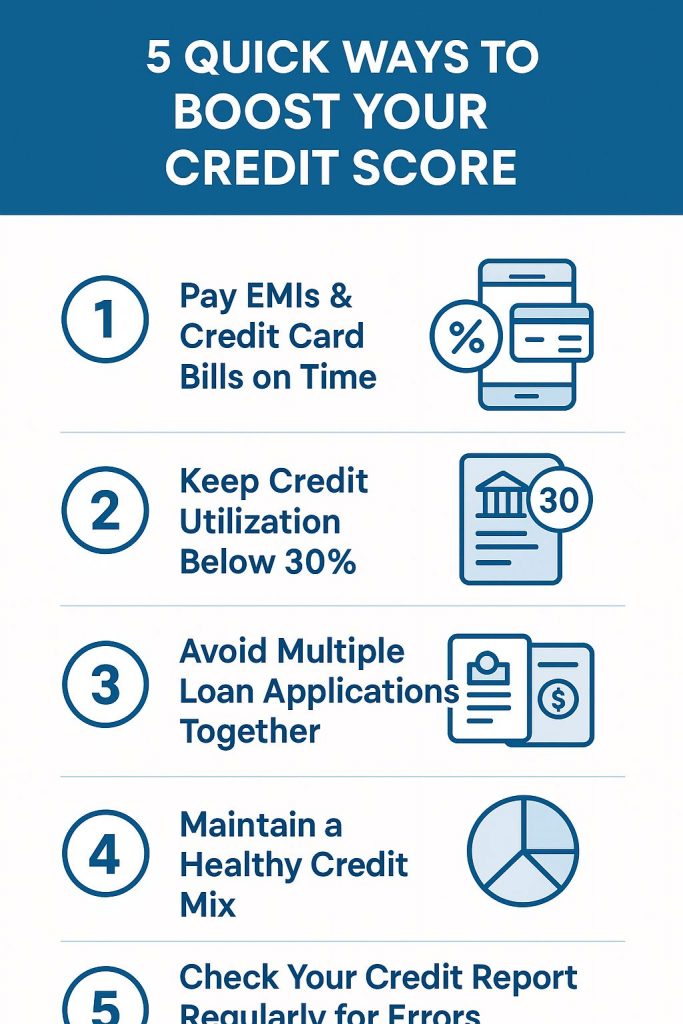

Tips to Improve Your CIBIL Score

-

Pay EMIs & Credit Card Bills on Time

-

Keep Credit Utilization Below 30%

-

Avoid Multiple Loan Applications Together

-

Maintain a Healthy Credit Mix

-

Check Your Credit Report Regularly for Errors

Common Myths About Credit Scores

❌ Checking your own credit score lowers it – FALSE!

✅ You can check your score as many times as you want without affecting it.

❌ Only income matters for loan approval – FALSE!

✅ Your repayment track record and credit behavior matter more.

❌ Once bad, score can’t be improved – FALSE!

✅ With consistent repayment and smart credit usage, scores can improve in 6–12 months.

Frequently Asked Questions (FAQs)

At least once every 3 months to monitor your financial health.

Yes, you can check your score for free on our platform.

No, personal checks are called “soft inquiries” and do not affect your score.

750 and above is considered excellent for most loan approvals.

Yes, it’s perfect for agents and DSAs to check customer eligibility instantly.